Published: 02:39 AM, 20 August 2018 Last Update: 02:41 AM, 20 August 2018

Summit's investment in Singapore jolts business arena

Experts urge govt for quick action

Forbes magazine has recently unveiled a list of the richest magnates in Singapore. Summit Group's Chairman Aziz Khan has been named on this list exposed by Forbes which is one of the most prominent business periodicals based in the United States. Aziz Khan holds the 34th place among the top 50 businessmen in Singapore.

Summit Group has assets of 91 crore US dollars in Singapore which is equal to 7, 644 crore taka. This figure is nearly one third of the costs for Padma Bridge project according to financial sources.

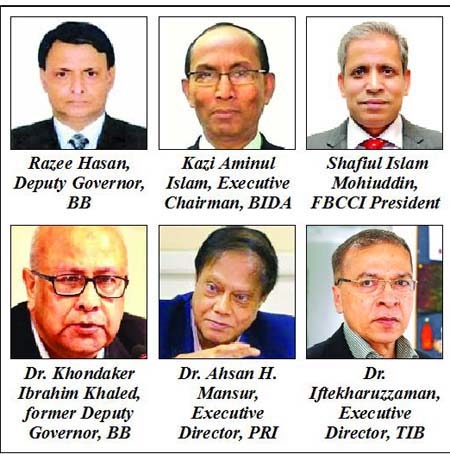

Bangladesh Financial Intelligence Unit (BFIU) has informed that Summit Group is not authorized to invest money in Singapore. Summit Group has not even applied to the authorities concerned to seek permission for this sort of overseas investment. Under these circumstances, Bangladesh Bank's Deputy Governor Razee Hasan has said that BFIU would look into the money transfer process of Summit Group.

Recently different newspapers and online portals have published reports on the enormous magnitude of assets Summit Group has piled up in Singapore with special references to its Chairman Aziz Khan. Since the financial institutions have not yet found any legitimate basis of Summit Group's mammoth investments in Singapore, inevitable questions have come up how this group managed to dispatch so much money to foreign locations.

Different government organizations including Bangladesh Bank (BB), BFIU and Bangladesh Investment Development Authority (BIDA) have taken the matter into serious consideration to find out the financial ins and outs of Summit Group and its Chairman Aziz Khan.

Bangladesh Bank's Deputy Governor Razee Hasan who is in charge of BFIU has said that Summit Group was not authorized to remit this money from Bangladesh to any other country including Singapore. Razee Hasan has told The Asian Age that it would be certainly investigated.

Officials from Anti Corruption Commission (ACC) have said that BFIU and Crime Investigation Department (CID) generally inquire about unauthorized money transfer from Bangladesh to foreign countries. ACC officials further said that ACC would scrutinize the issue if requests or proposals come from CID or BFIU.

Economists have said that transferring money overseas without proper authorization is tantamount to money laundering. Since the instances of money laundering have massively increased in recent times, Summit Group's investment in Singapore should be thoroughly examined according to financial experts.

Sources from National Board of Revenue (NBR) have said that Summit Group's income tax file does not mention any references to investments in Singapore. In terms of NBR rules investments and properties in foreign countries must be clearly described in income tax papers.

On the other hand, Summit Group's Chairman Aziz Khan has meanwhile said that all the investment of Summit Group is in Bangladesh. Forbes has stated the value of these investments, he added. Aziz Khan further said that Summit Group aims to invest 24, 000 crore taka in a number of sectors of Bangladesh including energy resources by 2022.

Aziz Khan who is now 63 years old has been residing in Singapore for last more than ten years. Summit Group is one of the influential stakeholders of Bangladesh's stock markets.

Different international quarters including Global Financial Integrity and Swiss banks have meanwhile referred to the rising sums of money transferred from Bangladesh to foreign countries during last several years. Domestic and overseas sources have stated that approximately 6 lakh crore taka has been laundered abroad from Bangladesh during last ten years.

Economic scholars have said that continuous financial scams are responsible for the extensively mounting figures of money laundering from Bangladesh.

Bangladesh Bank's former Deputy Governor Dr. Khondaker Ibrahim Khaled told The Asian Age, "In the current globalized era, Bangladeshi companies can invest in foreign countries but the central bank's regulations should be firmly obeyed. The government should obviously initiate required measures if Bangladesh Bank's rules are violated by investors or business groups."

Kazi Aminul Islam, Executive Chairman, Bangladesh Investment Development Authority (BIDA) said to The Asian Age, "I am not aware of Summit Group's ranking by Forbes. Summit Group is one of the largest organizations in Bangladesh's energy sector. But I have no idea about Summit Group's investments in foreign countries."

Shafiul Islam Mohiuddin, President, Federation of Bangladesh Chamber of Commerce and Industry (FBCCI) said to The Asian Age, "Stern actions should be taken if any business group sends money overseas by unfair means."

Dr. Ahsan H. Mansur, Executive Director, Policy Research Institute (PRI) told The Asian Age, "Summit Group should put forward all necessary facts and figures to the financial authorities regarding its local and international investments.

The central bank and other regulatory units should keep strong surveillance over the monetary transactions of all large business groups to avert illegal money transfer. It is very important to rise over political influence in such cases."

Dr. Iftekharuzzaman, Executive Director, Transparency International Bangladesh (TIB) said to The Asian Age, "Bangladesh Bank, NBR and Anti Corruption Commission should objectively investigate all the instances of money transfer from Bangladesh to other countries."